About

Our client is a US-based startup, with the main product being a wealth management robo-advisor platform. It is designed to help financial advisors create the best matching portfolio for their clients by providing a risk tolerance questionnaire and calculating individual Risk Score based on user data.

Challenge

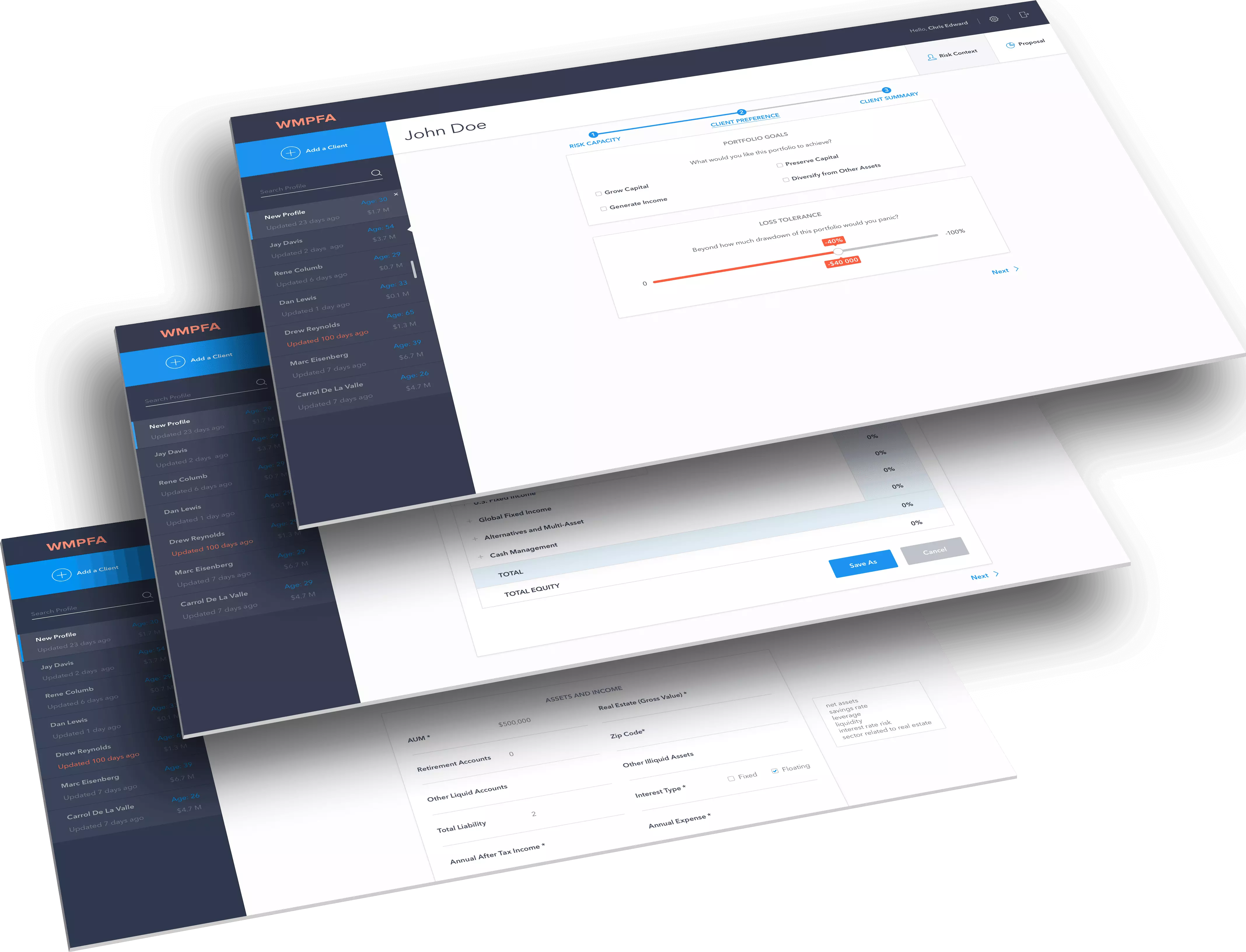

The goal of this project was to create a scalable SaaS platform capable of processing big volumes of user and historical stock market data. Upon collecting information from users and stock markets, the system should calculate the risk score, as well as provide the option of creating a portfolio manually.

Solution

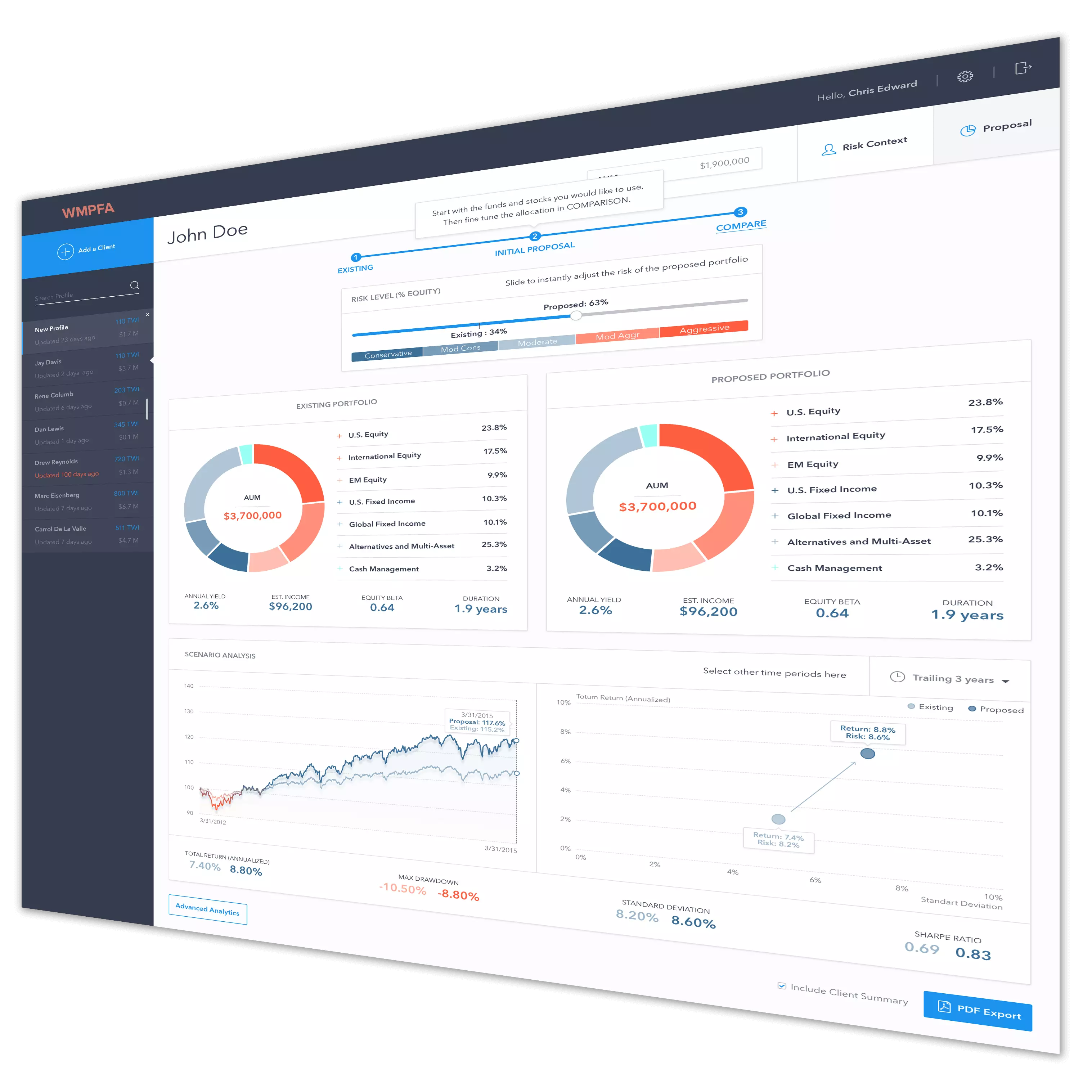

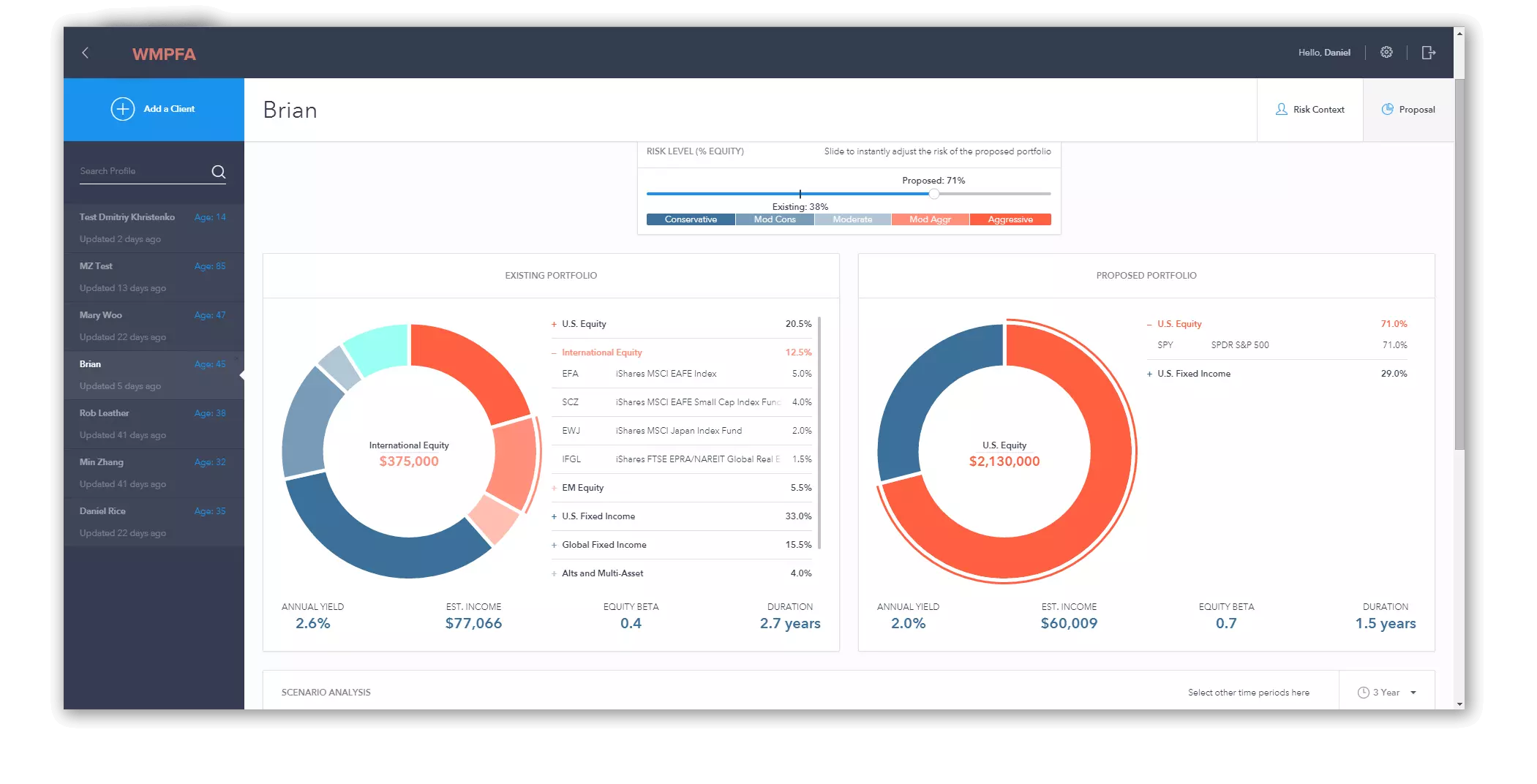

The service we built works with two data sources that collect different types of information. The first one includes all the info about the user: one’s age, experience, availability for work, monthly income, property, etc. This data needs to be collected in order to calculate how much risk a person can take based on the current life situation. On the client side, we implemented the option to manually expose the profit/risk ratio in the user investment strategy.

The second data source contains information on stocks, the bond market and its history for more than twenty years. This allows us to analyze the prospects of stocks and funds based on their trends over a long period and calculate the current portfolio risk score. This score is compared to the questionnaire-based risk score and helps the financial advisor build a better investment strategy for the client. For users’ convenience, all data is visualized with interactive charts and diagrams.

We built this wealth management platform as a cloud-based SaaS product with modular service-oriented architecture. The database stores over 200 000 000 records with stock market historical data since 1994 used for Portfolio Risk Score calculation. We implemented an advanced caching system to support high performance and quick response time.

The product has integration with multiple 3rd party services, including the following: market data API

market data API

payment processing/billing API syncing user portfolios with

various financial tools We also developed a public API allowing developers to integrate risk score calculation into their financial products.

payment processing/billing API syncing user portfolios with

various financial tools We also developed a public API allowing developers to integrate risk score calculation into their financial products.

Result

Since February 2016, the project has been available to users. Our team keeps working on improvements and support. We are currently automating the process of adding new funds market information to the database, which is issued globally on a daily basis.